Photo by Jingming Pan on Unsplash

Predicting Gold Prices Using Machine Learning: A Streamlit-Powered Guide

1. Introduction

Gold has long been a valuable asset, playing a crucial role in investment portfolios and financial markets. Its price often reflects economic conditions, making accurate forecasting an essential tool for investors and analysts. In this project, we harness the power of machine learning to predict gold prices using historical data and various economic indicators.

By analyzing and modeling data, we aim to uncover patterns and trends that influence gold price fluctuations. This hands-on guide will walk you through the process of using Python and Streamlit to build and deploy a predictive model, leveraging the gold price dataset from Kaggle.

2. Problem Definition and Data Overview

Problem Definition

The primary challenge is to accurately predict the price of gold based on historical data and related economic factors. With fluctuations in global markets and changing economic conditions, the ability to forecast gold prices is a valuable skill for investors and financial planners.

Our goal in this project is twofold:

Develop a machine learning model that predicts gold prices with high accuracy.

Deploy the model using Streamlit for easy accessibility and real-time usage.

Accurate predictions can assist stakeholders in making informed investment decisions, mitigating risks, and capitalizing on market opportunities.

Data introduction

The dataset consists of 2,290 rows and 6 columns, with each row representing a specific date and the corresponding values of various economic indicators. The columns and their meanings are as follows:

Date: The date corresponding to the recorded data (non-numerical, used for time-series analysis).SPX: The S&P 500 Index, a benchmark for stock market performance. Higher values indicate a strong stock market.GLD: The gold price (target variable), measured in US dollars. It represents the value of gold at the respective date.USO: A measure of crude oil prices, represented by the United States Oil Fund. It reflects the energy market trends.SLV: The silver price, measured in US dollars. It shows the value of silver, often correlated with gold prices.EUR/USD: The Euro-to-US Dollar exchange rate, indicating currency market trends.

Initial Observations

SPX and EUR/USD values reflect broader economic and market conditions that may indirectly influence gold prices.

USO, SLV, and GLD capture commodity trends, with potential interdependencies among them.

Gold prices range between 70.00 and 184.59, with an average value of 122.73, highlighting significant variability over time.

This overview provides critical context for the dataset, helping us understand the relationships between features and their potential impact on the target variable, GLD.

3. Exploratory Data Analysis (EDA)

Exploratory Data Analysis (EDA) is a crucial step in understanding the dataset’s structure and uncovering insights that drive the model-building process. In this project, we analyze the gold price dataset to identify patterns and correlations that could influence price predictions.

Dataset Overview

To get started, we load the dataset and examine its structure using Python’s pandas library:

# Load the dataset

users_data = pd.read_csv('gld_price_data.csv')

# Check the structure of the dataset

print(users_data.info())

print(users_data.describe())

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 2290 entries, 0 to 2289

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Date 2290 non-null object

1 SPX 2290 non-null float64

2 GLD 2290 non-null float64

3 USO 2290 non-null float64

4 SLV 2290 non-null float64

5 EUR/USD 2290 non-null float64

dtypes: float64(5), object(1)

memory usage: 107.5+ KB

None

SPX GLD USO SLV EUR/USD

count 2290.000000 2290.000000 2290.000000 2290.000000 2290.000000

mean 1654.315776 122.732875 31.842221 20.084997 1.283653

std 519.111540 23.283346 19.523517 7.092566 0.131547

min 676.530029 70.000000 7.960000 8.850000 1.039047

25% 1239.874969 109.725000 14.380000 15.570000 1.171313

50% 1551.434998 120.580002 33.869999 17.268500 1.303297

75% 2073.010070 132.840004 37.827501 22.882500 1.369971

max 2872.870117 184.589996 117.480003 47.259998 1.598798

Date SPX GLD USO SLV EUR/USD

0 1/2/2008 1447.160034 84.860001 78.470001 15.180 1.471692

1 1/3/2008 1447.160034 85.570000 78.370003 15.285 1.474491

2 1/4/2008 1411.630005 85.129997 77.309998 15.167 1.475492

3 1/7/2008 1416.180054 84.769997 75.500000 15.053 1.468299

4 1/8/2008 1390.189941 86.779999 76.059998 15.590 1.557099

The dataset overview provides the following insights:

- Structure:

The dataset contains 2,290 rows and 6 columns:

Date,SPX,GLD,USO,SLV, andEUR/USD.The

Datecolumn is of typeobject, while the other five columns are numerical (float64).

2. Data Quality: All columns have non-null values, indicating no missing data.

3. Descriptive Statistics:

SPX (S&P 500 Index):

Mean: 1,654.32, Std. Dev: 519.11

Wide range between Min (676.53) and Max (2,872.87), indicating high variability in the S&P 500 Index.

GLD (Gold Price):

Mean: 122.73, Std. Dev: 23.28

Values range from 70.00 to 184.59, reflecting significant variations in gold prices.

USO (Oil Fund):

Mean: 31.84, Std. Dev: 19.52

Large range from 7.96 to 117.48, highlighting volatility in oil prices.

SLV (Silver Price):

Mean: 20.08, Std. Dev: 7.09

Values span 8.85 to 47.26, showing moderate variability in silver prices.

EUR/USD (Currency Exchange Rate):

Mean: 1.28, Std. Dev: 0.13

A narrow range from 1.04 to 1.60, indicating relative stability compared to other variables.

4. Initial Observations:

GLDlikely has correlations with other variables (SPX,USO,SLV,EUR/USD) due to their economic interdependencies.High variability in

SPX,USO, andSLVmay reflect their influence on gold price movements.Consistent data quality (no null values) ensures smooth preprocessing and modeling.

This analysis sets the stage for exploring correlations and trends during EDA to identify patterns influencing gold price predictions.

Visualizing Gold Price Trends

To explore trends in the data, we visualize the gold prices over time:

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

from matplotlib.ticker import MaxNLocator

# Plot gold prices over time

plt.figure(figsize=(12, 6))

plt.plot(users_data['Date'], users_data['GLD'], label='Gold Price', color='gold')

# Format the x-axis to show more dense date labels

plt.gca().xaxis.set_major_locator(mdates.MonthLocator(interval=3)) # Set ticks every 3 months

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m'))

# Rotate the date labels for better readability

plt.xticks(rotation=45)

plt.title('Gold Price Trend Over Time')

plt.xlabel('Date')

plt.ylabel('Gold Price')

plt.legend()

plt.tight_layout()

plt.show()

The plot displays the trend of gold prices over time, highlighting the following key observations:

Overall Growth: Gold prices exhibit a significant upward trend, peaking around 2012, which reflects a period of heightened value for gold in the global market.

Volatility: The plot reveals substantial fluctuations, particularly during the rapid increase leading to the peak and the subsequent decline.

Stabilization: From 2014 onward, gold prices show a more stable pattern with moderate variations.

This analysis provides a comprehensive view of gold price movements over the years, setting the stage for further exploration of factors influencing these trends.

Correlation Analysis

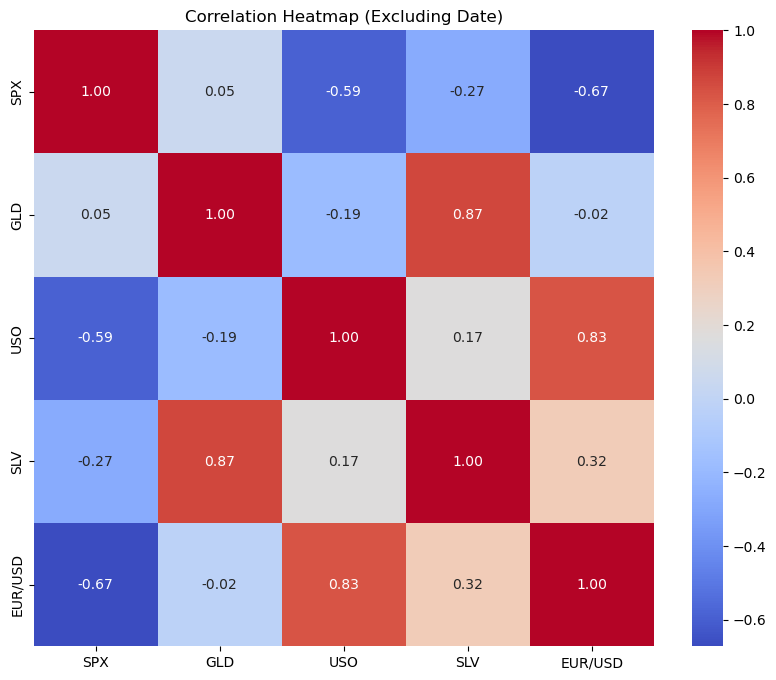

Understanding relationships between features is critical for feature selection. A correlation heatmap helps identify how strongly features are related to GLD:

# Exclude the 'Date' column before calculating correlations

correlation_matrix = users_data.drop(columns=['Date']).corr()

# Plot the heatmap

import seaborn as sns

import matplotlib.pyplot as plt

plt.figure(figsize=(10, 8))

sns.heatmap(correlation_matrix, annot=True, cmap='coolwarm', fmt='.2f')

plt.title('Correlation Heatmap (Excluding Date)')

plt.show()

This heatmap shows the correlation between numerical features in the dataset, excluding the Date column. Key observations include:

Strong Correlation:

GLD(gold price) has a strong positive correlation withSLV(silver price) (0.87), indicating a close relationship between gold and silver markets.Negative Correlations:

SPX(S&P 500 Index) andGLDshow a weak positive correlation (0.05), suggesting little dependence between them.EUR/USDandSPXhave a strong negative correlation (-0.67), indicating an inverse relationship between the exchange rate and the stock market index.

3. Notable Relationships: USO (oil prices) correlates moderately with EUR/USD (0.83) and weakly with GLD (-0.19), reflecting some indirect connections to gold prices.

These insights help identify which features are likely to influence gold prices and guide feature selection for model building.

4. Data Preprocessing

Data preprocessing is a critical step in preparing the dataset for machine learning modeling. It involves cleaning the data, handling missing values, and transforming features into a format suitable for analysis and modeling. For this project, the following preprocessing steps were applied:

Handling Missing Values

The dataset was first checked for missing values using the .isnull().sum() method:

# Check for missing values

print(users_data.isnull().sum())

Date 0

SPX 0

GLD 0

USO 0

SLV 0

EUR/USD 0

dtype: int64

Upon inspection, no missing values were found in the dataset. This ensures that no imputation or removal of rows is necessary, simplifying the preprocessing step.

Feature Scaling

Since the dataset contains features with different units and ranges (e.g., GLD in USD, SPX as an index, and EUR/USD as an exchange rate), feature scaling was applied to standardize the values. This ensures that no feature disproportionately influences the machine learning models:

from sklearn.preprocessing import StandardScaler

# Selecting numerical features (excluding 'Date')

features = users_data.drop(columns=['Date'])

scaler = StandardScaler()

scaled_features = scaler.fit_transform(features)

# Convert scaled features back to a DataFrame

scaled_data = pd.DataFrame(scaled_features, columns=features.columns)

Splitting Data into Features and Target

The target variable, GLD (gold price), was separated from the other features for model training:

# Separate features and target

X = scaled_data.drop(columns=['GLD'])

y = scaled_data['GLD']

Splitting Data into Training and Testing Sets

To evaluate the model’s performance, the dataset was divided into training and testing sets using an 80–20 split:

from sklearn.model_selection import train_test_split

# Split the data

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

These preprocessing steps lay the foundation for building accurate and robust predictive models for gold prices.

5. Feature Engineering

Since the Exploratory Data Analysis (EDA) already highlighted the relationships between features and the target variable GLD, we focus here on ensuring the dataset is optimized for model building. The key steps include:

Retaining All Features Initially

While SLV (silver price) and other features like USO (oil prices) and EUR/USD (exchange rate) are more strongly correlated with GLD, we retain all features (SPX, USO, SLV, EUR/USD) for the initial model training to avoid prematurely discarding potentially useful information.

Feature Importance

Instead of relying solely on correlation, we leverage feature importance from models like Random Forest to evaluate which features contribute most to predicting GLD. This analysis will be performed during the model evaluation step.

6. Model Building and Evaluation

Model building involves training machine learning algorithms to predict gold prices. Here’s how the process is structured:

Models Used

We train three machine learning models to predict GLD:

Linear Regression: A baseline model to capture linear relationships between features and the target.

Random Forest Regressor: An ensemble model that effectively handles non-linear relationships and feature interactions.

Gradient Boosting Regressor: A sequential learning model that minimizes errors over multiple iterations.

Model Training

Each model is trained on the training set (X_train, y_train) and evaluated on the test set (X_test, y_test).

Linear Regression

from sklearn.linear_model import LinearRegression

from sklearn.metrics import mean_squared_error, r2_score

# Train Linear Regression

lr_model = LinearRegression()

lr_model.fit(X_train, y_train)

# Predict and evaluate

y_pred_lr = lr_model.predict(X_test)

print("Linear Regression R^2 Score:", r2_score(y_test, y_pred_lr))

print("Linear Regression RMSE:", mean_squared_error(y_test, y_pred_lr, squared=False))

Linear Regression R^2 Score: 0.8975640982991402

Linear Regression RMSE: 0.32194718826931107

Random Forest Regressor

from sklearn.ensemble import RandomForestRegressor

# Train Random Forest

rf_model = RandomForestRegressor(random_state=42)

rf_model.fit(X_train, y_train)

# Predict and evaluate

y_pred_rf = rf_model.predict(X_test)

print("Random Forest R^2 Score:", r2_score(y_test, y_pred_rf))

print("Random Forest RMSE:", mean_squared_error(y_test, y_pred_rf, squared=False))

Random Forest R^2 Score: 0.9899859327093791

Random Forest RMSE: 0.10066159135413218

Gradient Boosting Regressor

from sklearn.ensemble import GradientBoostingRegressor

# Train Gradient Boosting

gb_model = GradientBoostingRegressor(random_state=42)

gb_model.fit(X_train, y_train)

# Predict and evaluate

y_pred_gb = gb_model.predict(X_test)

print("Gradient Boosting R^2 Score:", r2_score(y_test, y_pred_gb))

print("Gradient Boosting RMSE:", mean_squared_error(y_test, y_pred_gb, squared=False))

Gradient Boosting R^2 Score: 0.9802596392786268

Gradient Boosting RMSE: 0.14133056051673887

Model Comparison

The performance of three machine learning models — Linear Regression, Random Forest, and Gradient Boosting — was evaluated using two metrics: R² Score and Root Mean Squared Error (RMSE). Below are the results:

1. Linear Regression (R² Score: 0.8976, RMSE: 0.3219): Linear Regression provides a baseline performance with an R² score of 89.76%, indicating it explains most of the variability in the gold prices. However, the RMSE is relatively high compared to the other models, suggesting that the predictions are less accurate.

2. Random Forest (R² Score: 0.9900, RMSE: 0.1007): Random Forest demonstrates the best performance among all models. With an R² score of 99.00%, it captures almost all variability in the data. The low RMSE value highlights its high prediction accuracy, making it the most suitable model for this task.

3. Gradient Boosting (R² Score: 0.9803, RMSE: 0.1413): Gradient Boosting performs well, with an R² score of 98.03%, slightly below Random Forest. The RMSE is also higher than that of Random Forest but lower than Linear Regression, indicating good accuracy with slightly less robustness compared to Random Forest.

Overall, based on the evaluation:

Random Forest emerges as the best-performing model with the highest R² score and the lowest RMSE, making it the most reliable choice for predicting gold prices.

Gradient Boosting offers a strong alternative, especially for scenarios requiring a lighter model than Random Forest.

Linear Regression, while decent, is outperformed by the ensemble models in terms of both explanatory power and prediction accuracy.

The Random Forest model will be used in the deployment phase for real-time predictions.

8. Deployment and Practical Use

To make the gold price prediction model accessible and practical, we deployed the Random Forest model using Streamlit, a lightweight web application framework for Python. This allows users to interact with the model in real time and predict gold prices based on input features.

Saving the Model in main.py

After training the Random Forest model in your main script, save it using the joblib library:

import joblib

# Save the trained model to a pickle file

joblib.dump(rf_model, 'random_forest_model.pkl')

print("Model saved as 'random_forest_model.pkl'")

Setting Up Streamlit

Streamlit was chosen for deployment due to its simplicity and efficiency in creating interactive web applications. To install Streamlit, use the following command:

pip install streamlit

Creating the Streamlit App

The app accepts user inputs for features such as SPX, USO, SLV, and EUR/USD and predicts the gold price (GLD). Below is a sample code snippet for the app:

import streamlit as st

import numpy as np

import pandas as pd

import joblib # For loading the trained model

# Load the trained Random Forest model

model = joblib.load('random_forest_model.pkl')

# Streamlit app title

st.title("Gold Price Prediction App")

# Input fields for feature values

st.sidebar.header("Input Features")

spx = st.sidebar.number_input("S&P 500 Index (SPX)", value=1650.0, step=1.0)

uso = st.sidebar.number_input("Crude Oil Price (USO)", value=30.0, step=1.0)

slv = st.sidebar.number_input("Silver Price (SLV)", value=20.0, step=0.1)

eur_usd = st.sidebar.number_input("EUR/USD Exchange Rate", value=1.3, step=0.01)

# Predict button

if st.button("Predict Gold Price"):

# Create a DataFrame with the input values

input_data = pd.DataFrame({

'SPX': [spx],

'USO': [uso],

'SLV': [slv],

'EUR/USD': [eur_usd]

})

# Make a prediction

prediction = model.predict(input_data)

st.success(f"Predicted Gold Price: ${prediction[0]:.2f}")

Running the App

To run the app locally, navigate to the directory containing your script and execute the following command:

streamlit run app.py

This launches the app in your default browser, where you can input values for the features and get real-time predictions for gold prices.

The app after deployment will look like this:

Practical Use

This app can be used by:

Investors: To predict gold prices and make informed investment decisions.

Analysts: To analyze market conditions and their impact on gold prices.

Educational Purposes: As a learning tool for understanding the application of machine learning in financial forecasting.

9. Conclusion

In this project, we explored the process of predicting gold prices using machine learning techniques. By leveraging a dataset with historical gold prices and economic indicators, we developed and deployed a predictive model. The project encompassed key steps, including Exploratory Data Analysis (EDA), data preprocessing, feature engineering, model building, and deployment using Streamlit.

The Random Forest model emerged as the best-performing model, achieving an R² score of 99.00% and a Root Mean Squared Error (RMSE) of 0.1007, making it a robust choice for predicting gold prices. The deployment via Streamlit provided a user-friendly interface, enabling real-time predictions based on input features.

This project highlights the practical applications of machine learning in financial forecasting and demonstrates how to build, evaluate, and deploy models effectively. The approach can be extended to other financial assets or predictive tasks, providing valuable insights for investors, analysts, and educators.

By combining machine learning with deployment tools like Streamlit, we can bridge the gap between complex models and real-world usability, making data-driven predictions accessible to a broader audience.

Appendices

Code: https://github.com/Minhhoang2606/Gold-price-prediction-by-machine-learning

Data source: https://www.kaggle.com/datasets/altruistdelhite04/gold-price-data/data